Purchasing Real Estate Property For Novices

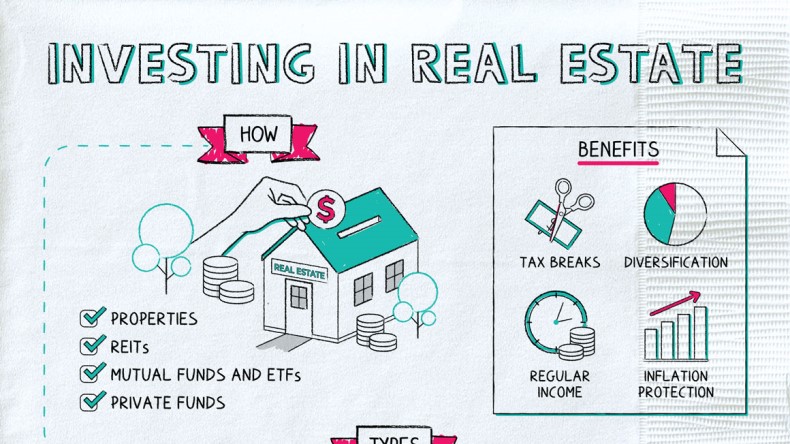

Real estate investment has always been defined as a proven means for developing money, real estate wholesaling yet beginners will find it difficult to browse through its complexities and create long lasting profits.

Beginners trying to attain their fiscal goals can investigate newbie-friendly shelling out techniques with our suggestions, referrals and vocabulary to acquire them going.

1. Real Estate Property Investment Trusts (REITs)

REITs provide buyers a different technique for purchasing real-estate without the need for the high set up investment capital needed to acquire home directly, with lower first ventures than straight getting real estate property directly. REITs are firms that own, function or financing earnings-producing real-estate across various sectors - typically publicly dealt - offering investors with diversified property assets at lower lowest investment portions than purchasing individual qualities immediately. Brokers can make either equity REITs which own actual real how do i invest in real estate estate immediately themselves mortgage REITs which maintain loans on real estate or crossbreed REITs which commit both kinds.REITs offers your collection with diversity rewards while they have reduce correlations to bonds and stocks than their classic brethren, although they're not tough economy-confirmation so it will be a good idea to speak to your fiscal advisor about how much of your stock portfolio must be purchased REITs according to your threat threshold and goals.

These REITs give brokers a chance to revenue through dividends that happen to be taxed as inventory dividends, but traders should bear in mind that REIT dividends can be influenced by factors like altering rates of interest and fluctuations in the real estate market place.

Based mostly on the sort of REIT you choose, it is crucial which you analysis its fiscal history and current functionality using SEC's EDGAR process. Just before making a choice to buy or promote REIT offers, consult a licensed dealer or monetary counselor who are able to provide up-to-date marketplace knowledge and manual a well informed selection - by doing this making sure you're acquiring ideal results in your assets.

2. Real-estate Expense Groupings (REIGs)

As a novice to real estate property shelling out, the experience can be both high-priced and intimidating. By becoming a member of a REIG you possess an opportunity to swimming pool both time and money along with other buyers to be able to reap profits swiftly with small work needed by you. REIGs are available both locally or over a nationwide scale and operate differently some demand account fees although some don't also, various REIGs need diverse quantities of fellow member contribution with some getting one organizer who deals with every little thing whilst other may work far more as relationships.No matter what REIG you pick out, it really is extremely important to execute substantial investigation just before shelling out. This could involve conducting interview and asking them questions of organization staff members in addition to reviewing past returns. You must also assessment what expense method your REIG pursues - are they dedicated to flipping attributes swiftly or is it looking at long term cash flow technology through lease home management?

Just like any kind of purchase, REIGs either can reward or cause harm to you financially to locate one suitable in your distinctive financial circumstances and threat patience is key.

If you're curious about signing up for a REIG, commence your search on the web or via referral off their buyers or industry experts. Once you find an attractive group, remember to speak to its organizer and comprehend their goals and dangers as well as capitalization rate (otherwise known as "limit") into position - this proportion helps estimate investment residence ideals and should engage in an important role when making judgements about enrolling in or departing an REIG.

3. Real-estate Syndication

Property syndications let traders to get being exposed to the market without being troubled with home growth and control commitments with an ongoing basis. Real estate property syndications consists of an LLC framework consisting of an energetic sponsor who handles money raising, purchase, organization getting yourself ready for particular resources passive traders receive distributions as outlined by a waterfall framework with original funds efforts becoming distributed back and later on handed out in accordance with an excellent return focus on (such as 7% internal level of return (IRR).Buyers also enjoy taxes pros included in the purchase package. Every year, they will be presented a Schedule K-1 exhibiting their income and deficits for your syndication, in addition to devaluation reductions because of charge segregation and increased depreciation of home.

Investment trusts can be well suited for newbies because of their reduce degree of chance compared to straight home acquisitions. But keep in mind that danger levels depend on every case according to factors like the local market place, residence kind and business plan.

To help make a well informed decision about purchasing real estate property syndications, it's necessary that you conduct research. This simply means analyzing entrepreneur supplies for example undertaking management summaries, total investment overviews, investor webinars and recruit staff path documents. When ready, arrange your house in the package by putting your signature on and examining its PPM verify certification reputation prior to wires cash to their profiles.

4. House Flipping

Property flipping can be an excellent technique for novice property traders to change a nice gain by getting very low and offering high. Even though this job requires lots of time and function, if done efficiently it may prove highly rewarding. Locating attributes with strong profit potential in locations folks desire to live is key here additionally enough funds also needs to be set aside so that you can full renovation of said house.Consequently, possessing a clear business strategy plan is of utmost importance for determining your targets and creating an measures decide to complete them. In addition, experiencing one may serve as an effective resource when evaluating buyers business strategy templates available on the internet may assist with creating one swiftly.

Commencing little will help you alleviate into these kinds of investment more effortlessly, and will allow you to understand its particulars faster. A solid assist community - which includes building contractors, local plumbers, electricians etc. will likely be vital.

Rookie property traders could also look at REITs, which are firms that own and control different attributes like medical centers, industrial environments, shopping centers, and household properties. Because they business publicly about the supply exchange they create them readily available for beginners.

Real estate investing might be highly rewarding if you the research and follow these tips. Considering the variety of options, there ought to be one excellent for you - but be wary to never overextend yourself financially before being ready or maybe it can lead to financial debt that can not be repaid.

5. Home Hacking

House hacking is an procedure for real estate property that involves purchasing then leasing back a portion of the purchased house to renters, supplying newbies having an suitable method to enter into the business without investing excessive advance. Month to month rental earnings should include home loan payments so it can help swiftly build equity.Property hacking can provide a great opportunity to familiarize yourself with becoming a landlord, since you will bargain specifically with tenants. Nonetheless, be mindful that home hacking is definitely an unforeseen expense method sometimes leasing earnings won't include mortgage payments entirely each month. Prior to diving in headfirst with this particular committing method it is essential that substantial consumer research be conducted.

Property hacking delivers another benefit by helping reduce as well as get rid of real estate costs entirely. As an example, buying a multifamily property which has added products you may rent could make residing in it more cost-effective when other people pays off your mortgage repayments immediately.

Residence hacking calls for located in the house you rent consequently it is crucial that you love dwelling there long-term and feel comfortable inside your surroundings. In addition, it's necessary that you think of how much function hiring out more than one devices in your house will demand, such as testing probable renters, getting rent repayments and managing tenant problems.